Crisis Investing: Bullworthy Talks with Leslie Kessler, CEO of PureSafe

As we've seen all too much this year alone, natural and man-made disasters have exposed drinking resources in those stricken communities to bacteriological and chemical contamination, making a once abundant clean drinking water source ineffectual in the greatest times of need. Leslie Kessler and I spoke on many different historical examples of catastrophes whose immediate first response relief has been swift and passionate, but not necessarily efficient as civil unrest and desperation threatened the prosperity of the relief efforts because of a prolonged lack to basic survival resources.

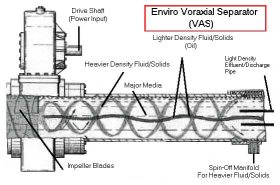

Ms. Kessler is the chief executive officer of PureSafe Water Systems, Inc., a company that has committed to developing PureSafe patented technology to provide purified drinking water to disaster response teams using a mobile unit specifically designed for rapid deployment worldwide. The unit can siphon water from any source albeit a lake, swimming pool, flood site, pumping it through the non-specific contaminant purification system- meaning it can decontaminate any and every strain of bacteria or pollutant with no need to test the water supply first for safety. The output takes only thirty minutes and can supply up to thirty thousand gallons of water a day, enough to serve forty-five thousand thirsty survivors and victims’ in portable bottles or bags onboard the unit.

PureSafe is considered a game changer among the disaster relief community that includes the government analysts testing the prototypes. While disaster relief is a highly collaborative effort among citizens and governments to suppress the damage and deliver resources and aid during an emergency in an efficient and well-organized fashion, the fundamental problem lies in distribution and the lack of preparedness protocol in public and private entities that are overwhelmed during these kinds of crisis (think of a hospital, for example). Take Hurricane Katrina as a practical model. The machine could have been air-lifted on a roof of by the stadium, connected it to contaminated flood water, and distribute it to the suffering people accordingly.

The company is currently undergoing government approval testing and in that effort, has hired on Underwriters Laboratories to help evaluate the electrical safety and performance of PureSafe’s First Response Water System functioning prototype. On today’s agenda is assessment of the uplift capabilities of the machine by crane.

The functions are simple enough so that the end-user only has to turn on the failsafe machine. Buyers of the mobile units (equipment with heavy-duty wheels built for abusive terrain and a helicopter-lift positioned onto the frame) are from the public and private sector and will include local, state, and federal agencies and departments including FEMA; hospitals and universities; the military, national guard and Homeland Security; hotels and many, many more national and international organizations that have interests in disaster response preparedness. The machines can be bought outright with warranties, leased, or rented with PureSafe providing on location support and staffing; towns and cities can also pool money together to buy one machine to share.

Ms. Kessler came into PureSafe in 2007 and immediately recognized that the existing technology was not fitting the needs of those demanding the kind of solutions the company was in the process of creating and subsequently, they started all over. They realized no company was totally focusing itself in the disaster response area that concerns water distribution while recent events have emphasized, now more than ever, that preparedness is the key – what if there’s an interruption in the water supply?

“It’s a great decision to be dealing with something that can make a difference and save people’s lives, and still be a very profitable company” said Ms. Kessler.

They’ve been attending conventions to network with potential buyers and investors this year. The company’s presentations have been extremely impressive: PureSafe is fulfilling a whitespace by providing a simple water purification service that can deliver potable water to thousands with the flip on an “on” switch. Ms. Kessler didn’t want to give information that has yet to be disseminated, but she did give a one-word response to questions concerning this year’s corporate performance that gives all the guidance shareholders need to hear: revenue.

Ms. Kessler confidently asserted that yes, in fact revenue will be booked this fiscal year and sales will be made. In July, the company will be presenting at a fire expo show with representatives from all over the Eastern seaboard that will offer major exposure for the PureSafe First Response Water System. The business structure is in place and the newly appointed board of directors is deeply experienced, knowledgeable, and very active. The workload and margins are in place and favorable. Finally, the need of the products are there, so what comes next, I asked her? It’s time to start selling inventory.

Here are some interesting links from PureSafe Water Systems:

· Water Purification Overview – from the website

· The Water Crisis Wiki – from the website

· Hottest Commodity to Invest In – from the website

· Water: Cycle of Life – PDF research from Leavitt Capital Management

Disclaimer I have not been compensated or paid by Puresafe Water Systems or their affiliates in stock, cash, or by any other means. Further, the author of this post nor his affiliates own stock or interest in this featured company.

For comments or questions please contact Tom Copeland from the contact page.

Labels: bullworthy, CRISIS INVESTING, DAY TRADER, financial crisis, FIRST RESPONSE WATER SYSTEM, first-time investor, learn options, LESLIE KESSLER, NATURAL DISASTER RELIEF, PSWS, PURESAFE, PURESAFE WATER SYSTEMS, stocks, tom copeland, WATER TREATMENT, WATER TREATMENT CRISIS, youtube